Financial literacy is hard for most people. Knowing all the values and calculations you need is often stressful and more confusing than it should be. We will show you the 13 most useful calculators that will help you develop your financial literacy and achieve financial wellness. Use these tools to plan, revise, and build the financial freedom you seek and be confident in your current strategies.

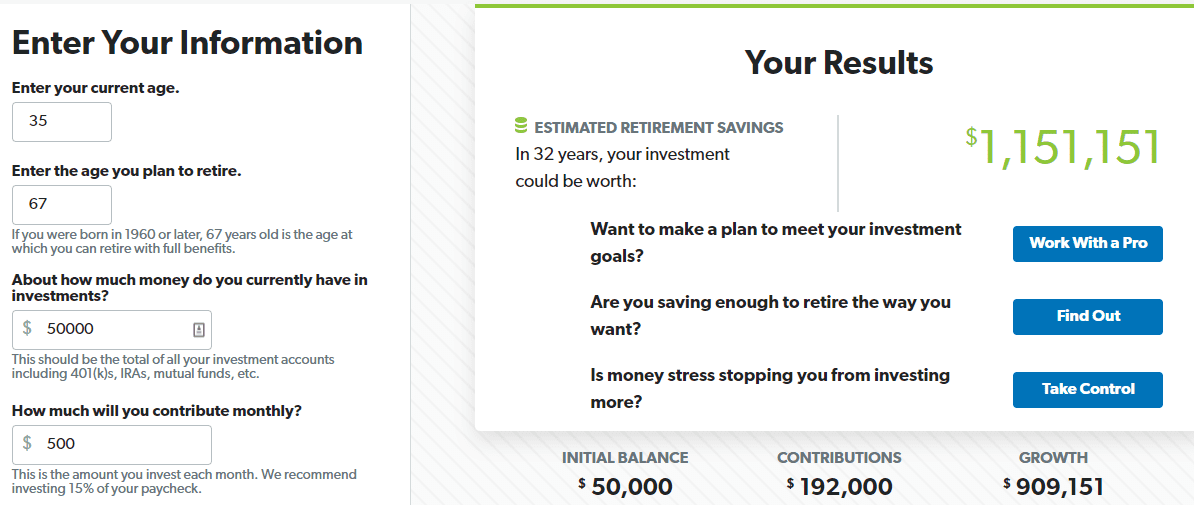

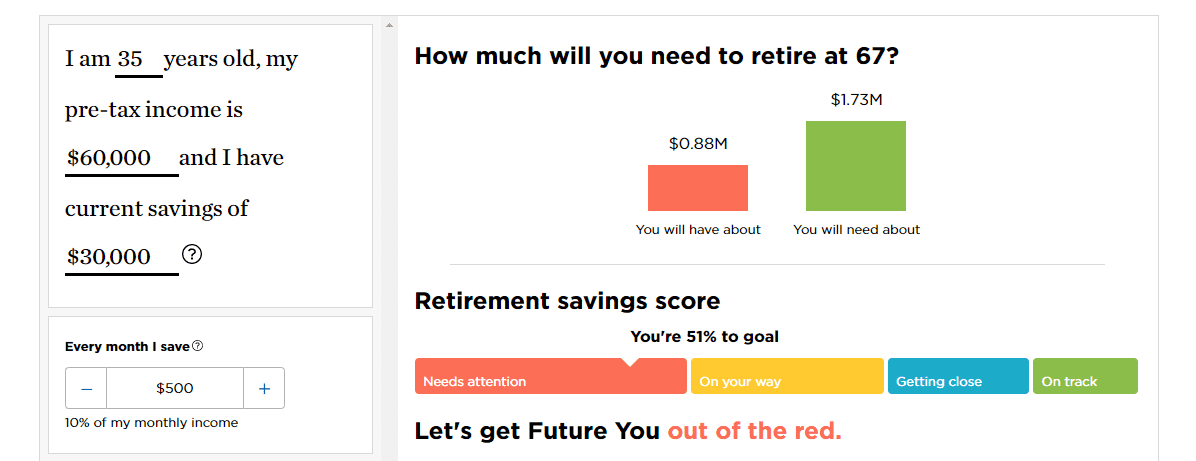

1. Retirement Calculator

How much do you need to retire? Are you in line with the goals you’ve set? Is your income high enough? All these questions can be answered using this retirement calculator. Quickly calculate how much you’ll need, when you can retire, and what to expect.

Use this link to access the calculator:

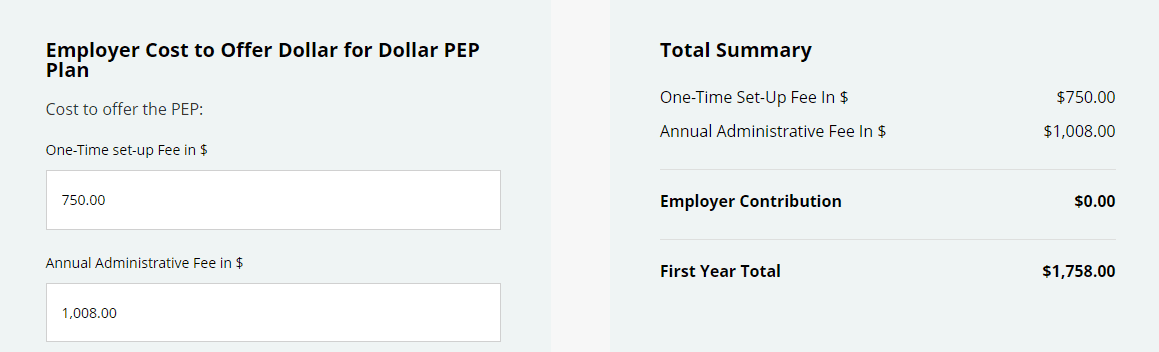

2. Are you a business owner?

To be competitive in today’s market, offering retirement plans are a must and in some states a requirement by law. Use this calculator to see the actual cost required for an employer-sponsored retirement plan (you’ll be surprised how cost-effective it is).

Use this link to access the calculator:

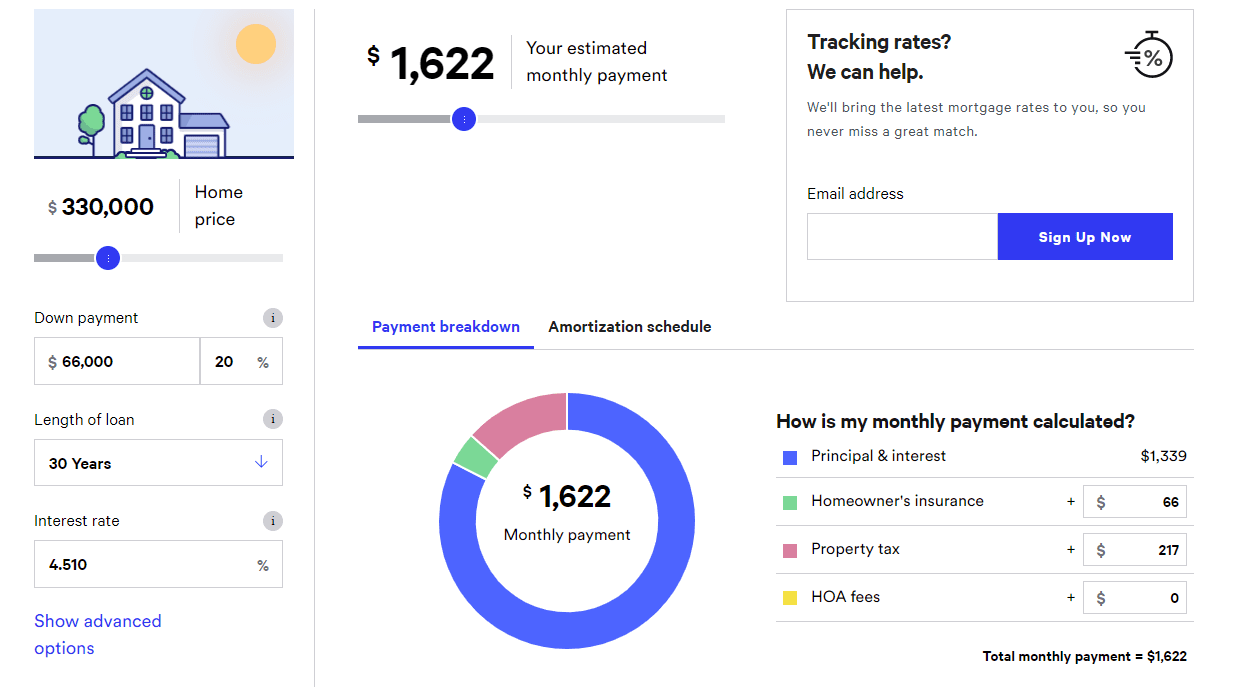

3. Mortgage Calculator

With the housing market exploding right now, it’s good to know what you’re in for when buying a new house or trying to refinance. This calculator takes everything into account, including property taxes, interest rate, length of the loan, etc. This will produce your estimated monthly payment to help you determine what you can afford.

Use this link to access the calculator: https://www.bankrate.com/calculators/mortgages/mortgage-calculator.aspx

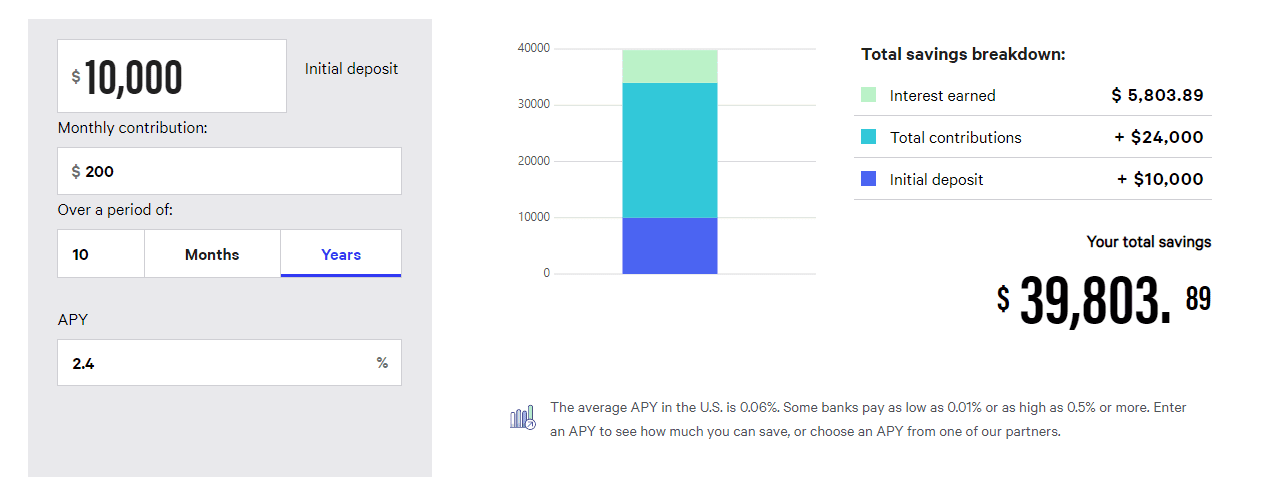

4. Savings Calculator

Most people find saving for the future to be quite difficult. The biggest roadblocks tend to be: How much do I need to start? What will my savings turn into over time? Is it worth it to save money? Easily predict what your future may look like with this simple savings calculator.

Use this link to access the calculator: https://www.bankrate.com/calculators/savings/simple-savings-calculator.aspx

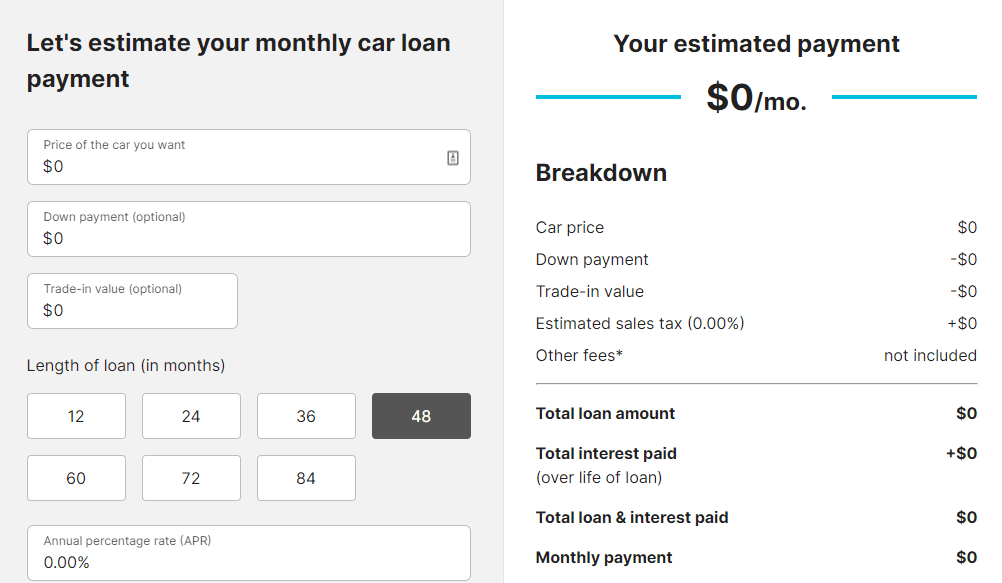

5. Car Loan Calculator

Are you thinking of buying a new car? It’s important to know how much it will cost you each month before you commit to a hefty bill that you can’t afford. Estimate your monthly car loan payment in under 3 minutes.

Use this link to access the calculator: https://www.cars.com/car-loan-calculator/

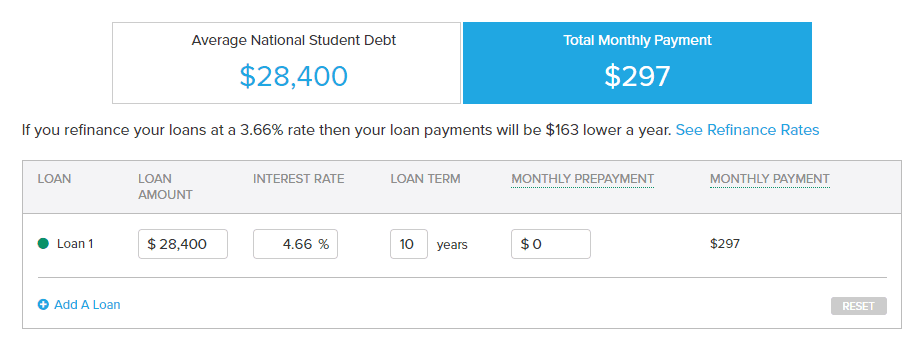

6. Student Loan Calculator

Student loan debt is a crushing pressure on the finances of many Americans. Understand with confidence what you will need to pay back, and how the money is being allocated (amortization). See all your student loans in one place and see how you match up against the average national student debt.

Use this link to access the calculator: https://smartasset.com/student-loans/student-loan-calculator

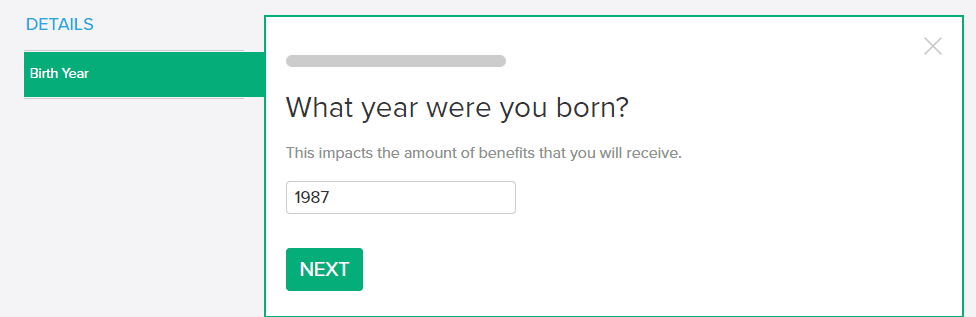

7. Social Security Calculator

The pain we feel when we see our paycheck after social security is deducted is real. We might as well know how much we could receive each month when we hit retirement age. See how your money could circulate back into your wallet. This calculator even accounts for inflation, and other factors. Estimate your potential social security income!

Use this link to access the calculator: https://smartasset.com/retirement/social-security-calculator

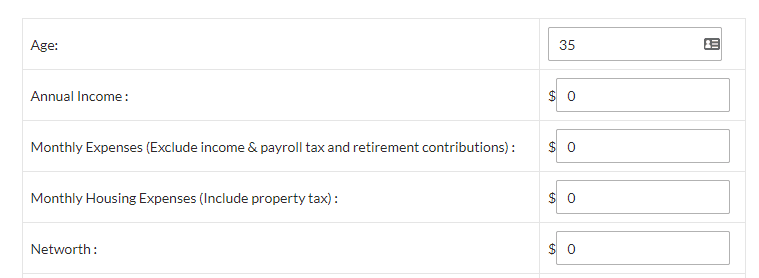

8. Financial Health Calculator

Are you financially healthy? Building the knowledge base necessary to be financially independent doesn’t have to be hard. Here’s a quick tool to do a health check of yourself financially. It will give you a score based on input data and tell you what to work on. Compare your finances to other households and people around the same age. How do you stack up against others?

Use this link to access the calculator: https://personalfinancedata.com/financial-health-calculator/

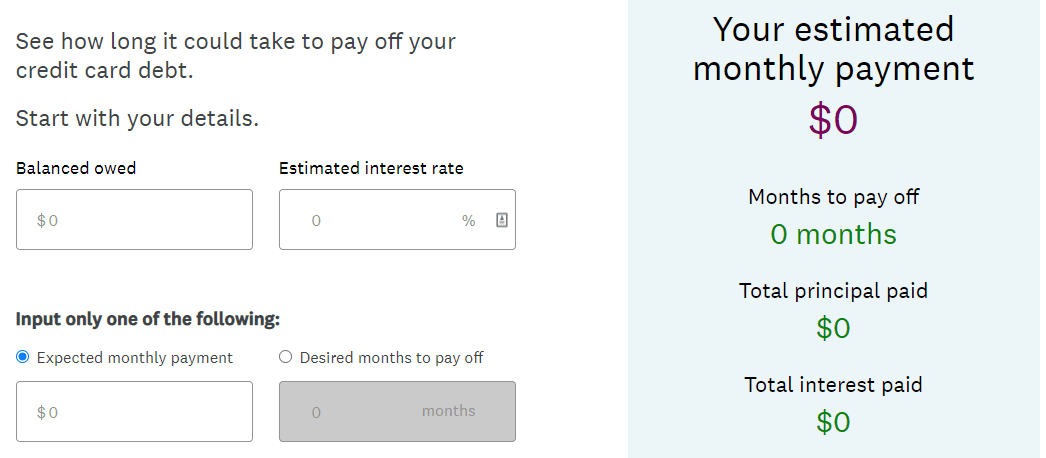

9. Debt Calculator

Having bad debt is crippling to your bank account. Determine the fastest and most effective route to paying off your debts. Be better than the near 45.4 million households that are currently in debt in America. Use this calculator to determine how long it will take and how much it will cost you after interest. Let’s calculate your repayment plan!

Use this link to access the calculator: https://www.creditkarma.com/calculators/credit-cards/debt-repayment

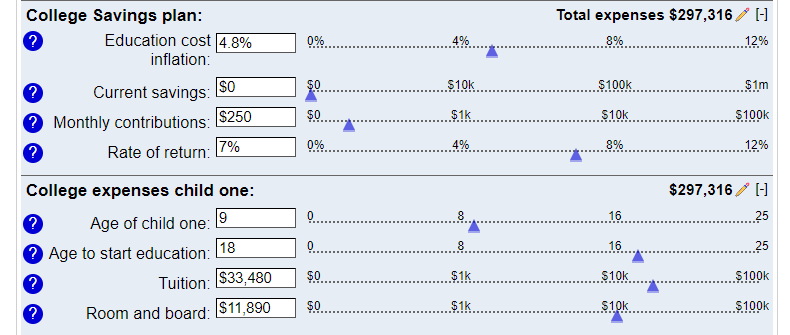

10. College Savings Calculator

Investing in your child’s future is a big task and something that most hope to do eventually. Many fall short of that goal when they imagine how much money it will take. This calculator covers all bases, and we think you may be surprised how little it takes each month to secure your child’s future. Starting planning with the help of this calculator

Use this link to access the calculator: https://www.bankrate.com/calculators/savings/saving-for-college-calculator.aspx

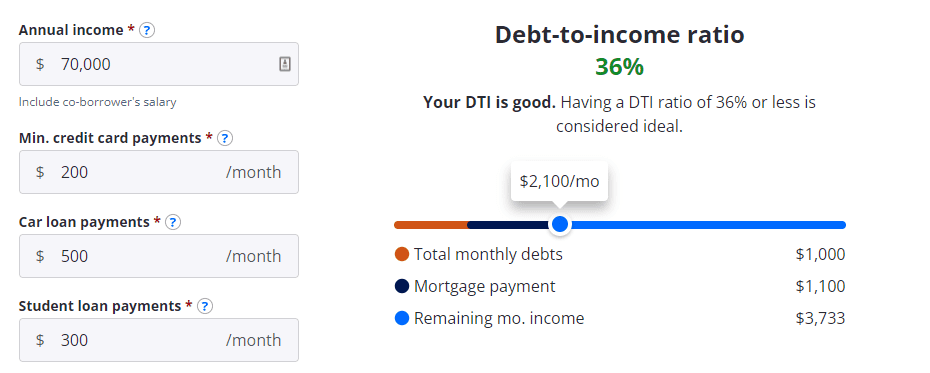

11. Debt to Income Calculator

Knowing your debt-to-income ratio is critical. Many lenders look at the debt-to-income ratio to calculate if you’re ready to take on additional debt. So, if you plan on taking on a loan soon or want to have a better ratio for peace of mind then use this calculator to see where you stand. Understand what is considered high or low debt to income ratio and work on fixing or staying at that level.

Use this link to access the calculator: https://www.zillow.com/mortgage-calculator/debt-to-income-calculator/

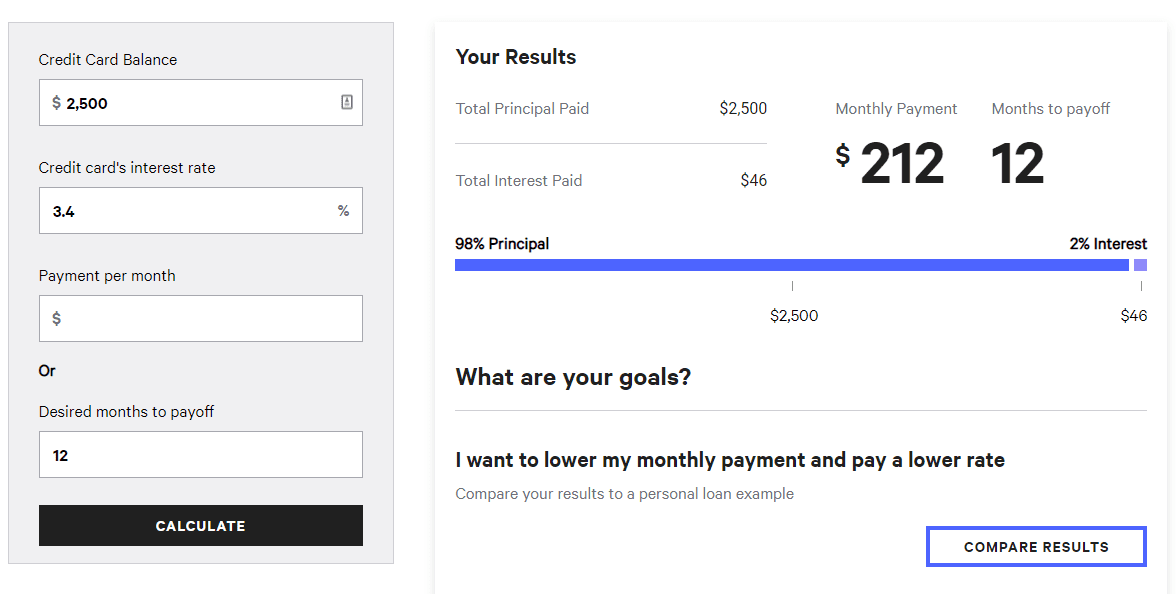

12. Credit Card Calculator

Are you behind on a large payment for your credit card? Use this calculator to easily decipher when you can become debt-free. Don’t let credit and debt rule your life behind the scenes. Input your credit card balance and interest rate and this calculator will tell you exactly how much you need to pay per month to hit your goal. Predict and chart your path to being debt-free.

Use this link to access the calculator: https://www.bankrate.com/finance/credit-cards/credit-card-payoff-calculator/

13. Net worth Calculator

Knowing your net worth can be both a motivator and a guide to evaluating areas in which you can improve. Combine all your assets and liabilities to accurately calculate what you are worth. Unnecessarily allocating money to wrong places is what often plagues most Americans.

Understanding the concept of compounding and how assets can grow over time is vital. Investing can have some predictable growth, and it is important to know how growth can turn your money into wealth in the future. Use this calculator to accurately predict what your portfolio (investments) could turn into

Use this link to access the net worth calculator: https://www.ramseysolutions.com/retirement/net-worth-calculator

Use this link to access the compound interest calculator: https://www.ramseysolutions.com/retirement/investment-calculator